Welcome back to Closingbell Gems #07. We’re looking at Gran Tierra Energy.

Let’s start this email off with some investment and market-related tweets from the last few weeks.

P.S. Free to join our Discord Community here.

Top Tweets

Here are our top 3 investment and market-related tweets from the last few weeks.

Macro view of the market by Raoul Pal

The takeaway from Raoul Pal: “We have a high risk of a sharp recession that is over quickly and another risk-off. It is not a certainty. The odds of a bigger recession are lower but could change. Inflation is a past problem.”

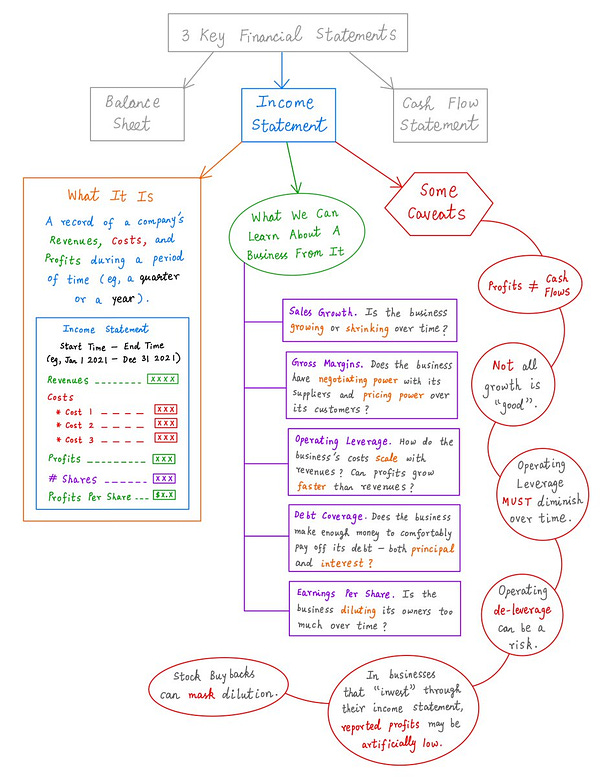

Reading income statements by 10k Diver

A breakdown by Alex Morris on Peloton

Now onto Gran Tierra Energy (GTE: AMEX):

Gran Tierra Energy

Gran Tierra Energy has a Closingbell Valuation Index of 21% making it relatively undervalued in the Energy sector.

About Gran Tierra Energy

Gran Tierra Energy Inc is an independent energy company. It is engaged in the acquisition, exploration, development, and production of oil and gas properties in proven, under-explored hydrocarbon basins that have access to established infrastructure.

The firm produces primarily light crude oil, supplemented with medium crude and natural gas. Gran Tierra holds interests in producing and prospective properties in Colombia and prospective properties in Ecuador.

The company has a strategy that focuses on establishing a portfolio of producing properties, plus production enhancement and exploration opportunities to provide a base for future growth.

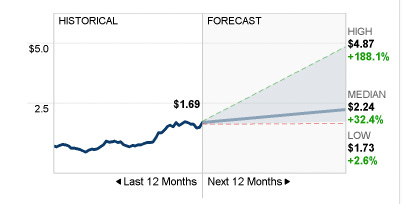

📈 Price Forecast by Analysts

The 8 analysts offering 12-month price forecasts for Gran Tierra Energy Inc have a median target of 2.24, with a high estimate of 4.87 and a low estimate of 1.73. The median estimate represents a +32.44% increase from the last price of 1.69.

Recent Headlines

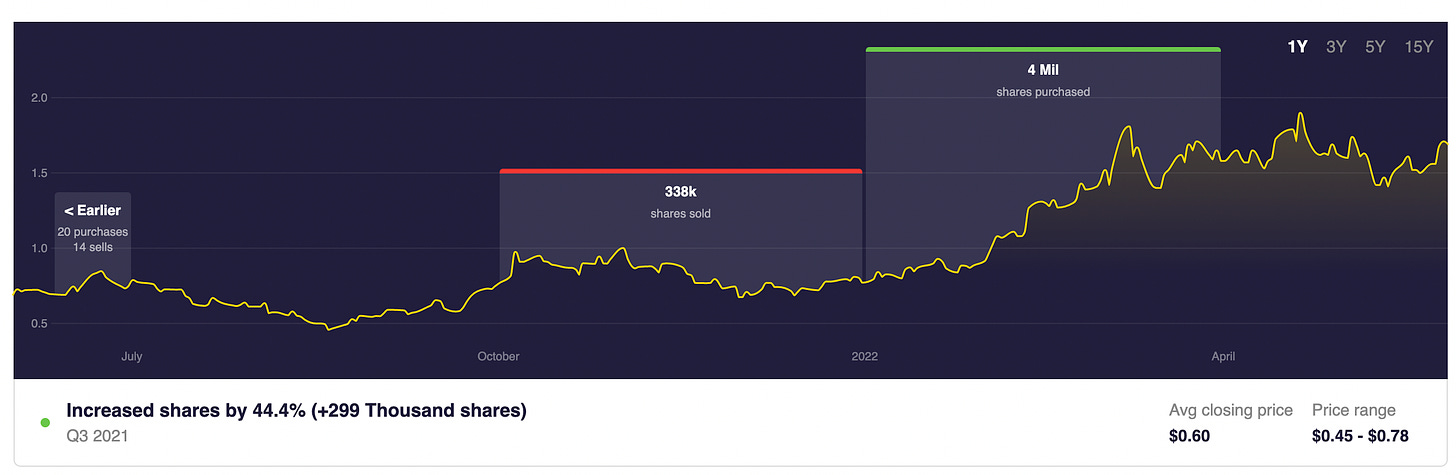

Insider Buys

Jim Simons

Jim Simons acquired 5.04 Million Gran Tierra Energy shares worth $8.46 Million. That's 0.01% of their equity portfolio (1156th largest holding). The investor owns 1.35% of the outstanding Gran Tierra Energy stock. The first Gran Tierra Energy trade was made in Q2 2013. Since then Jim Simons bought shares twenty more times and sold shares on fifteen occasions. The stake cost the investor $5.66 Million, netting the investor a gain of 49% so far.

Ken Griffin

Ken Griffin acquired 76.4 Thousand Gran Tierra Energy shares worth $128 Thousand. That's 0.0% of their equity portfolio (5043rd largest holding). The first Gran Tierra Energy trade was made in Q2 2013. Since then Ken Griffin bought shares 34 more times and sold shares on 27 occasions. The stake costed the investor $55.3 Thousand, netting the investor a gain of 132% so far.

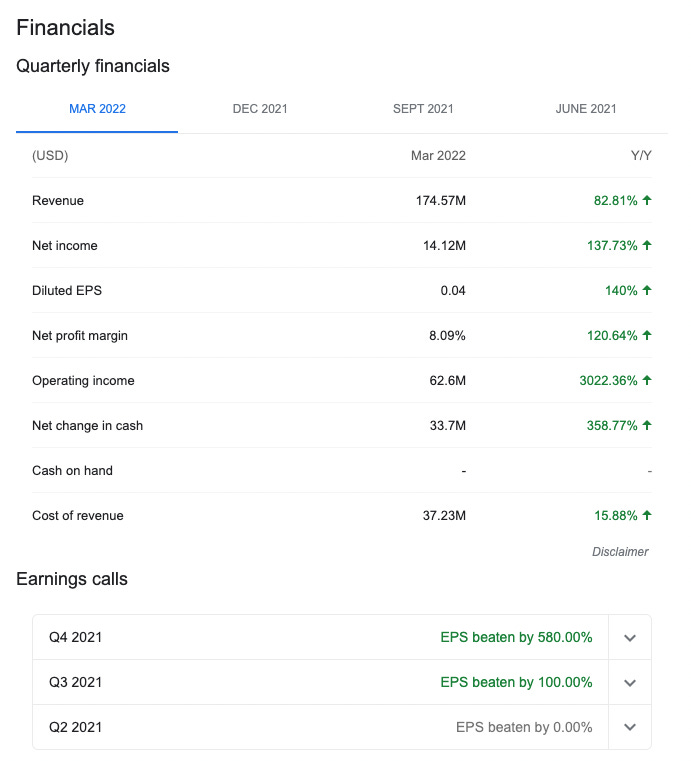

Quarterly Financials

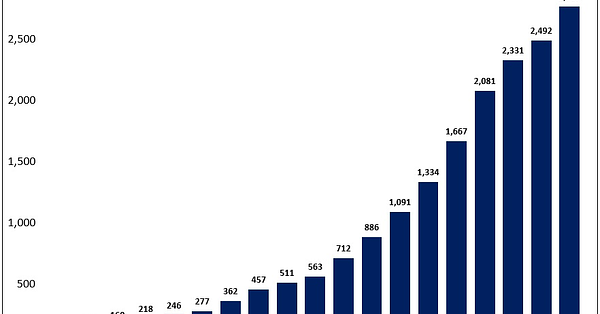

GTE saw Year-over-Year improvements across:

✅ Revenue

✅ Net Income

✅ Diluted EPS

✅ Net Profit Margin

✅ Operating Income

✅ Cost of Revenue

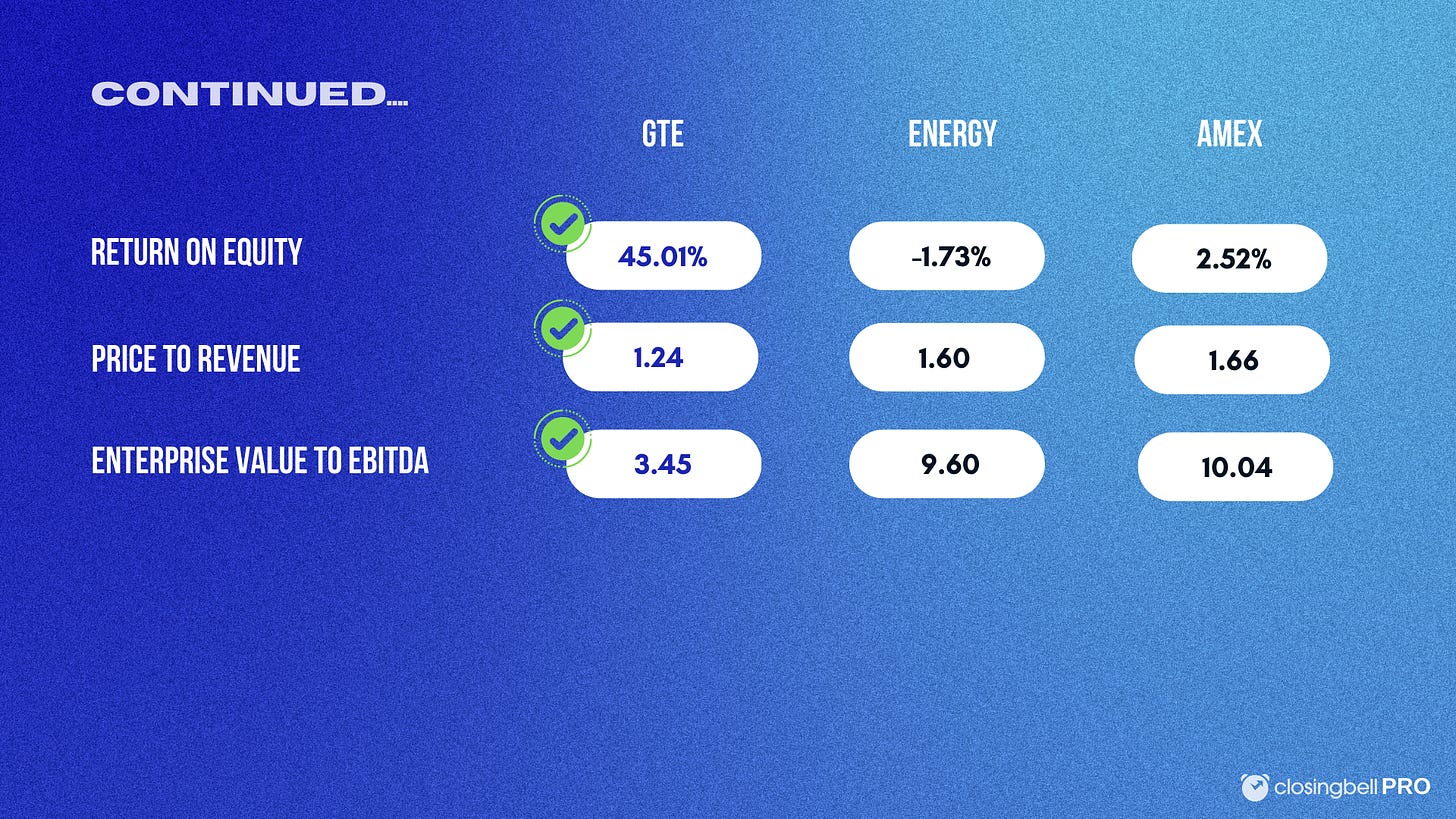

Fundamentals

✅ GTE beat both: (a) the Energy and (b) AMEX Co’s across 6 key fundamental metrics

❌ GTE has a worse Trailing Dividend Yield and Price-to-Book Ratio than the Market

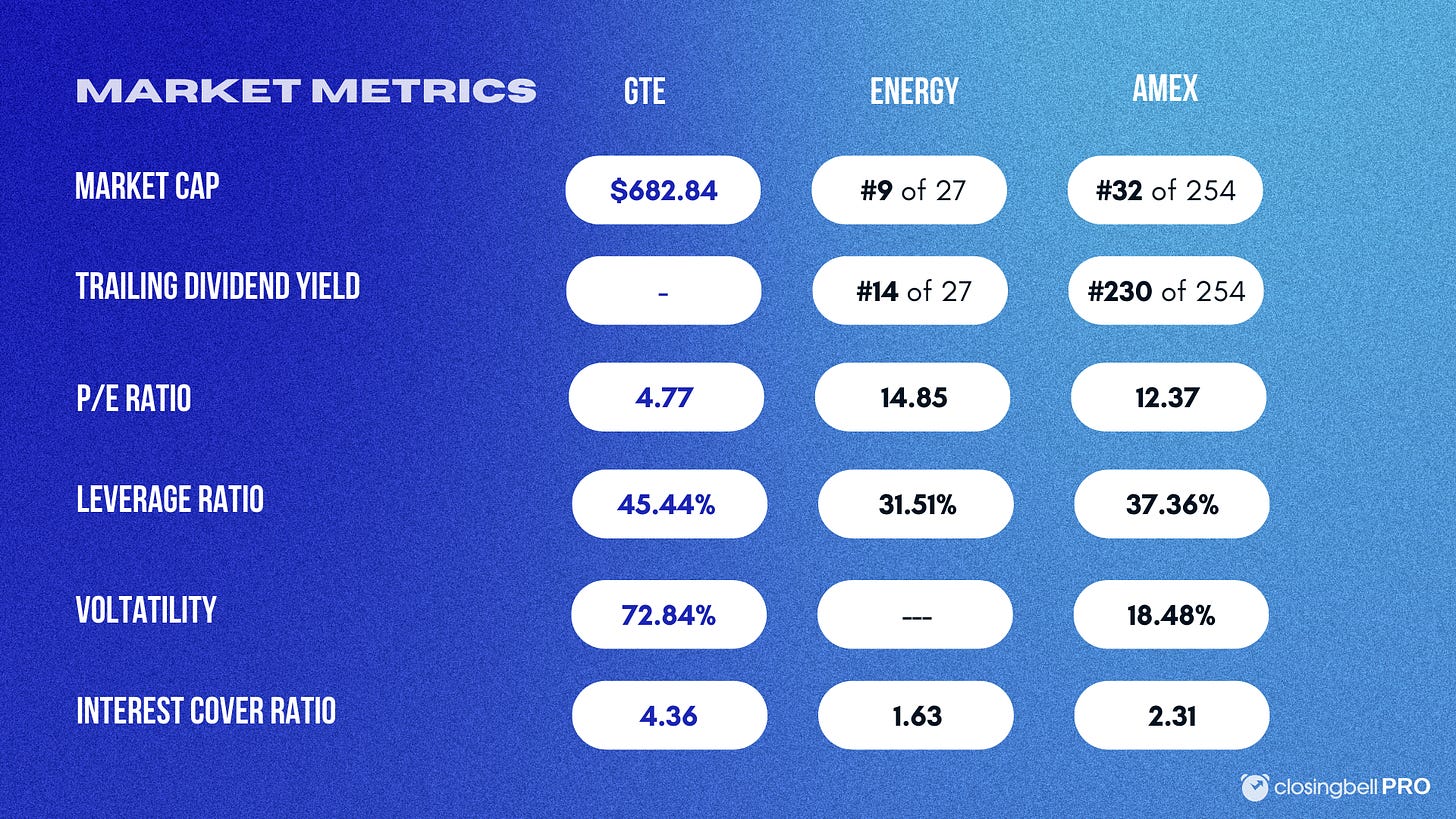

Market Metrics

✅ GTE beat both: (a) the Energy and (b) AMEX Co’s in P/E Ratio

❌ GTE has a worse Leverage Ratio, Volatility and Interest Cover ratio

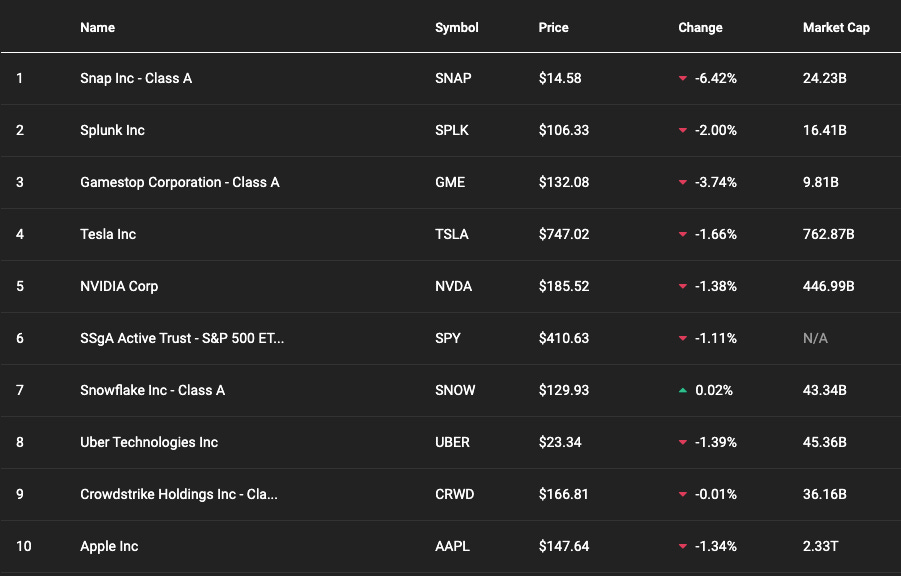

Trending on Slack and Discord

Snapchat, Splunk, Gamespot, Tesla, and NVIDIA take out the top 5 positions on the Closingbell Slack and Discord Lookup charts over the last week.

Thanks for taking the time to read this! See you next week.

Regards,

Luca

CEO, Closingbell

For behind the scenes action, follow along here: twitter.com/lucamonk

Thanks for reading everyone! If you’re down here in the comments, we’d love some feedback on structure or preferred bits of information :) Let us know 🤝